Financial Crisis As Explained to My 14 Year Old Sister - Kevin Nguyen

Kevin: I’m getting to that. Let’s say that the Charizard is worth $50, so in case you decide to not return my money, at least I’ll have something that’s worth what I loaned out.

Olivia: Okay.

Kevin: But one day, people realize that Pokémon is stupid and everyone decides that the cards are overvalued. That’s right—everybody turned twelve on the same day! Now your Charizard is only worth, say, $25.

Four Stages of Global Financial Crisis – Ajay Shah

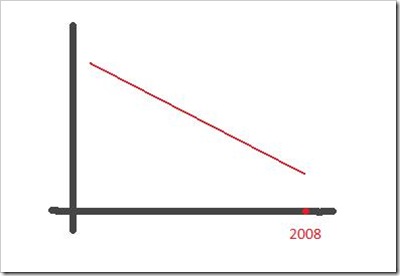

The first place to focus on was US housing construction. US housing was clearly in stratospheric territory. Once the US Fed started raising rates, and Mortgage Equity Withdrawal became less important, trouble was going to come about in US home construction. In this period, I watched the DJ US Home Construction Index.

Can a US Style Financial Crunch Happen In India? – Prof. Jayant Varma

Another way of looking at the Indian situation comes from reading Ellis’ paper “The housing meltdown: Why did it happen in the United States?”, BIS Working Paper 259. Many of the factors mentioned by Ellis are equally applicable to India:

- The supply elasticity of real estate construction has been very high in the current boom (compared to the past) and this supply overhang has the potential to deepen the correction that is required.

Rationality of Panic – Steve Coll in New Yorker

People don’t generally panic in the sunshine. They panic in the dark. And we are in the dark about what assets and liabilities are truly held in what has been properly labeled the “shadow banking system”

No comments:

Post a Comment